Covid-19 has affected all of us with equal gusto. Lots of hardships have been faced both by common man and businesses. However, there is a silver lining for all those who are planning to buy their dream abode.

Here’s how.

Prices

In the current COVID-19 scenario, the residential real estate sector has taken a beating. Prices of residential projects in Mumbai have corrected at least 10-15% due to oversupply and weak demand.

Sales have declined by almost 49% in the first half of 2020 across the top seven cities as compared with the same period, last year, according to a report by ANAROCK Property Consultants.

Prices have bottomed out and developers are prioritizing cash flows over profitability. Housing prices are currently ruling at lower than 2012 level and there is minimal scope of further correction.

Improving consumer sentiments

A consumer survey by ANAROCK conducted during the lockdown period says 72 per cent buyers still prefer to buy a property, out of which 44 per cent have not changed their plans. Interestingly, 12 per cent respondents who were previously not planning to buy, are now interested.

In fact, millennials who favoured rental properties before, now want to buy a property for end-use.

Reduced ownership cost

Property prices have already softened with a fair amount of correction in markets like Mumbai. The cost of ownership is perhaps lowest in a decade and EMIs have come down to almost 700 per lakh from1,000 per lakh.

As a result, there is an available buying opportunity which buyers with adequate liquidity must consider.

Repo rate

With RBI’s series of Repo Rate cuts, the repo rate now stands at 4%, lowest since years. It translates to lower EMIs. Which means, there would be less outgo in terms of EMI.

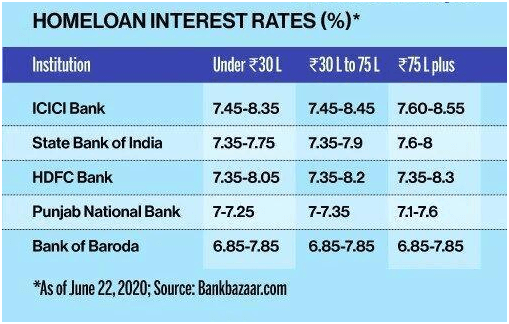

Currently, some of the lowest interest rates are under 7%, going as low as 6.85%. One year ago, at the start of July, the lowest rates were in the range of 8.55 to 8.75 per cent,” says Adil Shetty, Chief Executive Officer at BankBazaar.

So, this reduction in interest rates, although small in percentages, will lead to a fair amount of reduction in your EMI. Depending upon the loan amount, you can save from a hundred to a couple of thousand rupees a month. Also, compounded over the full tenure of the loan, small monthly deductions translate into several lakh rupees.

Deals and offers

Numerous builders and developers are offering discounts to match the affordability of home buyers and at the same time push their sales figure and increase revenue.

But what if there is a downpour of not to be missed offers coming straight to you?

Well, believe it or not, it’s true.

Ashwin Sheth Group has some amazing offers under its #RaintrestingDeals.

It includes:

- No GST on residential projects

- Booking amount of just Rs. 51,000/-

- Refundable booking

- Lowest prices guaranteed

The new projects in Mumbai by Ashwin Sheth Group where you can avail the above offers are:

- Sheth Avalon (Thane West)

- Sheth Zuri (Thane West)

- Sheth Montana (Mulund West)

- Sheth Midori (Dahisar East)

Thus, all the above things signal that it is the right time to buy. Make the most of low interest rates and such attractive offers.

So, start your buying journey by visiting our Facebook Page to set up an appointment.